In a recent decision, the Full Bench of the Fair Work Commission has decided that modern award annualised wage clauses will be substantially changed.

What are Annualised Wage Clauses?

Broadly speaking, annualised wage clauses are award provisions which allow employers to pay employees an annualised wage (i.e. a salary) instead of paying the employee for each discrete award entitlement (“Salary”).

For example, an employer may choose to pay a full-time employee a flat yearly salary which includes any allowances, overtime and penalty rates the employee may become entitled to under an award.

By doing so, the employer avoids the administrative burden of tracking the employee’s weekly hours, determining which award entitlements are applicable for that week, and then calculating the employee’s weekly pay.

Arguably, an employer can already do this without an award’s annualised wage clause. Employers can pay employees a salary which remunerates an employee for most award entitlements, by making using of the set-off principles explained in cases such as James Turner Roofing

However, in light of these proposed changes, and the decisions in Stewart v Next Residential [2016] WAIRC 00756 and Linkhill Pty Ltd v Director Office of Fair Work Building Inspectorate [2015] FCAFC 99, it may be legally safest for employers who wish to pay an employee a Salary to make use of an applicable award’s annualised wage clause where one is available.

What will change?

The Full Bench decided that awards that already contain annualising wage clauses (and the Pastoral and Horticultural awards) will have those clauses replaced by a ‘revamped’ annualised wage clause.

The proposed revamped clauses contain three notable features. These are:

- specification of whether employers must obtain an employee’s agreement to pay that employee a Salary;

- new notification and record-keeping requirements; and

- a requirement to perform a ‘reconciliation’ every 12 months (or on termination of employment).

Each of these features is explained in more detail below.

When must employers obtain an employee’s agreement to pay that employee a Salary?

Most affected awards are divided into two categories. The major difference being whether the new clause requires an employer to obtain an employee’s agreement before the employer can pay the employee a Salary.

Awards which cover employees who work reasonably stable hours will not require employee agreement before an employer can pay that employee a Salary.

In contrast, awards which cover employees who work highly variable hours will require employers and employees to agree to a Salary before the employer can pay that employee a Salary.

This table sets out which awards require employee agreement. The information in the table may change, as the Full Bench has not yet made a final decision regarding which awards will require employee agreement.

Notification and record-keeping requirements

The revamped clauses will contain several notification and record-keeping obligations, which employers will need to follow as to comply with the relevant award.

Broadly, employers will be required to advise employees in writing of:

- the Salary that the employee will be paid;

- which provisions award entitlements the Salary will satisfy;

- the method by which the Salary was calculated (including any overtime and penalty rate assumptions used in the calculation);

- when the employee will be paid more on top of their Salary for working certain hours. For this, the employer must advise the employee of the outer limit of hours which the Salary covers; and

- that the employee will be paid each discrete award entitlement (such as overtime) for hours worked beyond that outer limit of hours.

Employers will also be required to keep a record of the above information.

Records must be kept of each unpaid break an employee takes and the employee’s starting and finishing times. The employee must sign this record each week.

Requirement to perform reconciliations

Under the proposed revamped clauses, employers will be required to conduct a “reconciliation” every 12 months (or when employment ends) for each employee on a Salary.

This “reconciliation” requires employers to, in effect, review the employee’s work pattern across the previous 12 months and calculate how much the employee would have earned if they had been paid each discrete award entitlement.

If the employee’s Salary is lower than that amount, employers will be obliged to reimburse the employee for the shortfall within 14 days.

Some awards require a loading to be paid

Three awards also require employers to pay employees an additional loading on top of the employee’s Salary in addition to the above requirements.

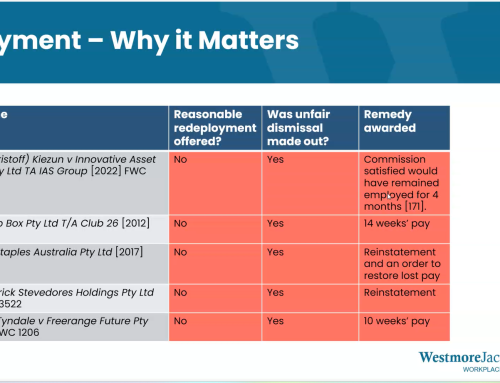

The table shows which awards will obligate employers to pay a loading on top of an employee’s Salary.

Conclusion

Broadly, these proposed changes significantly reduce the administrative ease for employers that annualised wage clauses previously offered under certain awards.

The proposed introduction of the reconciliation and additional record-keeping requirements means that employers will have to keep records and calculate how much an employee would have earned during a particular period under the applicable award, regardless of the fact the employee is being paid a Salary. This removes much of the administrative benefit in paying an employee a Salary where an applicable award contains an annualised wage clause.

Adam Colquhoun

Principal, WestmoreJacobs

This article is general information only. It is not legal advice. If you need legal advice, please contact us.